You invest 3000 you have speculated – Investing $3000 can be a daunting task, but with the right knowledge and strategies, it can be a rewarding one. This comprehensive guide will provide you with everything you need to know about investing $3000, from setting investment goals to managing risk.

As you embark on this investing journey, it’s crucial to understand the potential investment goals, available investment options, and effective investment strategies. By considering key investment considerations, managing risk, and monitoring and rebalancing your portfolio, you can increase your chances of success.

Investment Objectives

When an individual invests $3000, their primary objective is to achieve financial growth and security. The specific goals may vary depending on individual circumstances, but common investment objectives include:

1. Capital Appreciation: The investor aims to increase the value of their investment over time, outperforming inflation and generating real returns.

2. Income Generation: The investor seeks to generate regular income from their investment, such as dividends or interest payments, to supplement their current cash flow.

3. Retirement Planning: The investor invests for the long term to accumulate funds for their retirement, ensuring financial security during their golden years.

4. Tax Savings: Some investments, such as tax-advantaged accounts, offer tax benefits that can reduce the overall cost of investing.

Factors Influencing Investment Goals

Several factors influence an individual’s investment goals, including:

- Risk Tolerance:The investor’s willingness to take on risk determines the types of investments they choose. High-risk investments have the potential for higher returns but also carry greater volatility.

- Time Horizon:The length of time the investor plans to invest affects their investment strategy. Long-term investors can tolerate more risk, while short-term investors may prefer more conservative investments.

- Financial Situation:The investor’s current financial situation, including income, expenses, and debts, impacts their investment decisions. Those with higher incomes and lower expenses may be able to invest more aggressively.

Investment Options

Individuals with $3000 to invest have access to various investment options, each with its own risk and return profile.

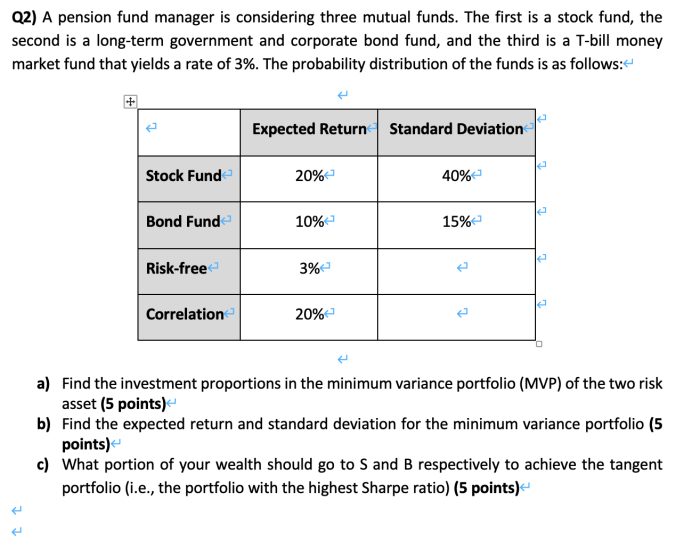

One option is to invest in stocks, which represent ownership in a company. Stocks offer the potential for high returns, but also carry the risk of losing value.

Bonds

Bondsare loans made to companies or governments. They offer lower returns than stocks, but generally carry less risk.

Mutual Funds

Mutual fundsare professionally managed portfolios that invest in a variety of stocks, bonds, or other assets. They offer diversification, reducing risk compared to investing in individual securities.

Exchange-Traded Funds (ETFs)

ETFsare similar to mutual funds, but trade on exchanges like stocks. They offer lower fees than mutual funds and provide more flexibility.

Investment Strategies

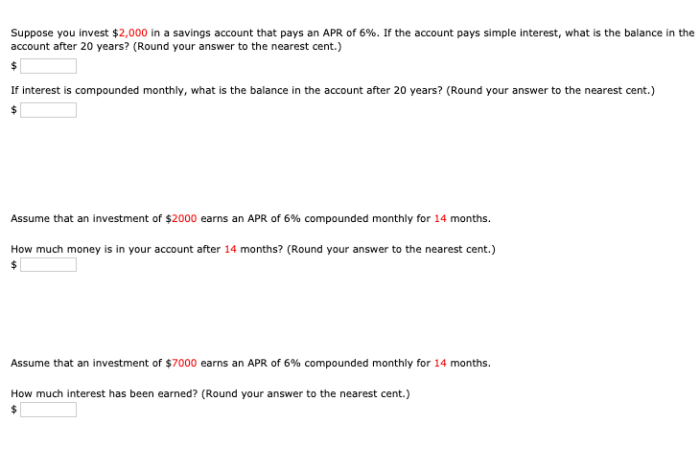

When investing with a limited amount of capital like $3000, it is essential to carefully consider and implement an appropriate investment strategy. Various strategies exist, each with its own advantages and disadvantages.

One common strategy is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market conditions. This approach reduces the impact of market fluctuations and can be beneficial for investors who are not comfortable with the volatility of the market.

Value Investing

Value investing involves identifying and investing in undervalued companies that have the potential for significant growth. Value investors believe that these companies are trading at a discount to their intrinsic value and can provide a higher return on investment over time.

Growth Investing

Growth investing focuses on identifying and investing in companies that are expected to experience rapid growth in the future. These companies often have high earnings potential and are typically in industries with high growth rates.

Investment Considerations: You Invest 3000 You Have Speculated

When investing $3000, several key considerations should be taken into account to maximize returns and mitigate risks. These include diversification, fees, and taxes.

Diversification involves spreading investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of fluctuations in any one market. This helps to balance the portfolio and reduce overall risk.

Fees

Investment fees can significantly impact returns over time. These fees may include management fees, transaction fees, and account maintenance fees. It is important to compare fees between different investment options and choose those with the lowest costs to maximize returns.

Taxes, You invest 3000 you have speculated

Taxes can also affect investment returns. Capital gains taxes are levied on profits made from the sale of investments, while dividends and interest income are subject to income taxes. Understanding the tax implications of different investment options can help investors make informed decisions and minimize tax liability.

Risk Management

Managing risk is crucial when investing $3000. It involves identifying, assessing, and mitigating potential risks to preserve capital and achieve investment goals.

Various risk management techniques exist, including:

Asset Allocation

- Diversifying investments across different asset classes (e.g., stocks, bonds, real estate) reduces overall risk.

- By allocating funds based on risk tolerance and investment horizon, investors can minimize exposure to any single asset class.

Stop-Loss Orders

- These orders automatically sell a security when it falls below a predetermined price, limiting potential losses.

- Stop-loss orders help preserve capital by preventing further declines in the value of an investment.

Hedging

- Hedging involves using financial instruments (e.g., options, futures) to offset potential losses in an underlying investment.

- By taking an opposite position in a correlated asset, investors can reduce the impact of adverse price movements.

Monitoring and Rebalancing

Monitoring and rebalancing an investment portfolio is crucial to maintain its alignment with investment objectives and risk tolerance. It involves regularly assessing the portfolio’s performance, composition, and risk profile to ensure that it remains on track.

Factors that may trigger a rebalancing include significant changes in market conditions, such as shifts in asset class valuations or economic outlook. Changes in investment goals, such as retirement or major life events, can also necessitate a rebalancing.

Monitoring

Effective monitoring involves tracking key metrics such as portfolio value, asset allocation, and risk measures. Regular reviews allow investors to identify any deviations from the target portfolio composition or risk parameters.

Rebalancing

Rebalancing involves adjusting the portfolio’s asset allocation to bring it back in line with the target allocation. This may involve selling overvalued assets and purchasing undervalued ones. Rebalancing helps to maintain diversification and reduce risk by ensuring that the portfolio is not overly concentrated in any one asset class or sector.

Case Studies

Investing $3000 can be a daunting task, but it is possible to achieve success with careful planning and execution. Several individuals have successfully invested $3000 and achieved significant returns. Here are some real-world case studies:

Warren Buffett

Warren Buffett is one of the most successful investors of all time. He started investing at a young age and has grown his wealth to over $100 billion. Buffett’s investment strategy is based on value investing, which involves buying stocks that are trading below their intrinsic value.

He looks for companies with strong fundamentals, such as a competitive advantage, a strong management team, and a healthy balance sheet. Buffett is also a patient investor, and he is willing to hold stocks for many years until they reach their full potential.

Peter Lynch

Peter Lynch is another legendary investor who managed the Fidelity Magellan Fund from 1977 to 1990. During his tenure, the fund returned an average of 29.2% per year, which is more than double the return of the S&P 500 index.

Lynch’s investment strategy was based on growth investing, which involves buying stocks of companies that are expected to grow rapidly. He looked for companies with strong earnings growth, a high return on equity, and a low price-to-earnings ratio.

Lessons from Case Studies

The case studies of Warren Buffett and Peter Lynch provide valuable lessons for investors of all levels. Here are some of the key takeaways:

- Invest for the long term. Both Buffett and Lynch are patient investors who are willing to hold stocks for many years. This allows them to ride out market fluctuations and achieve long-term success.

- Do your research. Before investing in any stock, it is important to do your research and understand the company’s business model, financial statements, and competitive landscape.

- Diversify your portfolio. Don’t put all your eggs in one basket. Instead, diversify your portfolio by investing in a variety of stocks, bonds, and other assets.

- Be patient. Investing is a marathon, not a sprint. Don’t expect to get rich quick. Instead, be patient and let your investments grow over time.

Frequently Asked Questions

What are some common investment goals?

Common investment goals include saving for retirement, buying a home, funding a child’s education, or generating passive income.

What are some factors that influence investment goals?

Factors that influence investment goals include risk tolerance, time horizon, and financial situation.

What are some investment options available for $3000?

Investment options for $3000 include stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

What are some investment strategies that can be employed with $3000?

Investment strategies that can be employed with $3000 include dollar-cost averaging, value investing, and growth investing.